Прочети на Български ==> Read in English (US)

In this Spendee review, we'll take a look at the pros and cons of the app, its pricing, what users say about it, and how to navigate the interface.

In a previous post, we walked through the various finance apps for freelancers you can take advantage of when managing your money.

Today, we'll dive a bit deeper into one of these apps, and thoroughly review its features. Let's go:

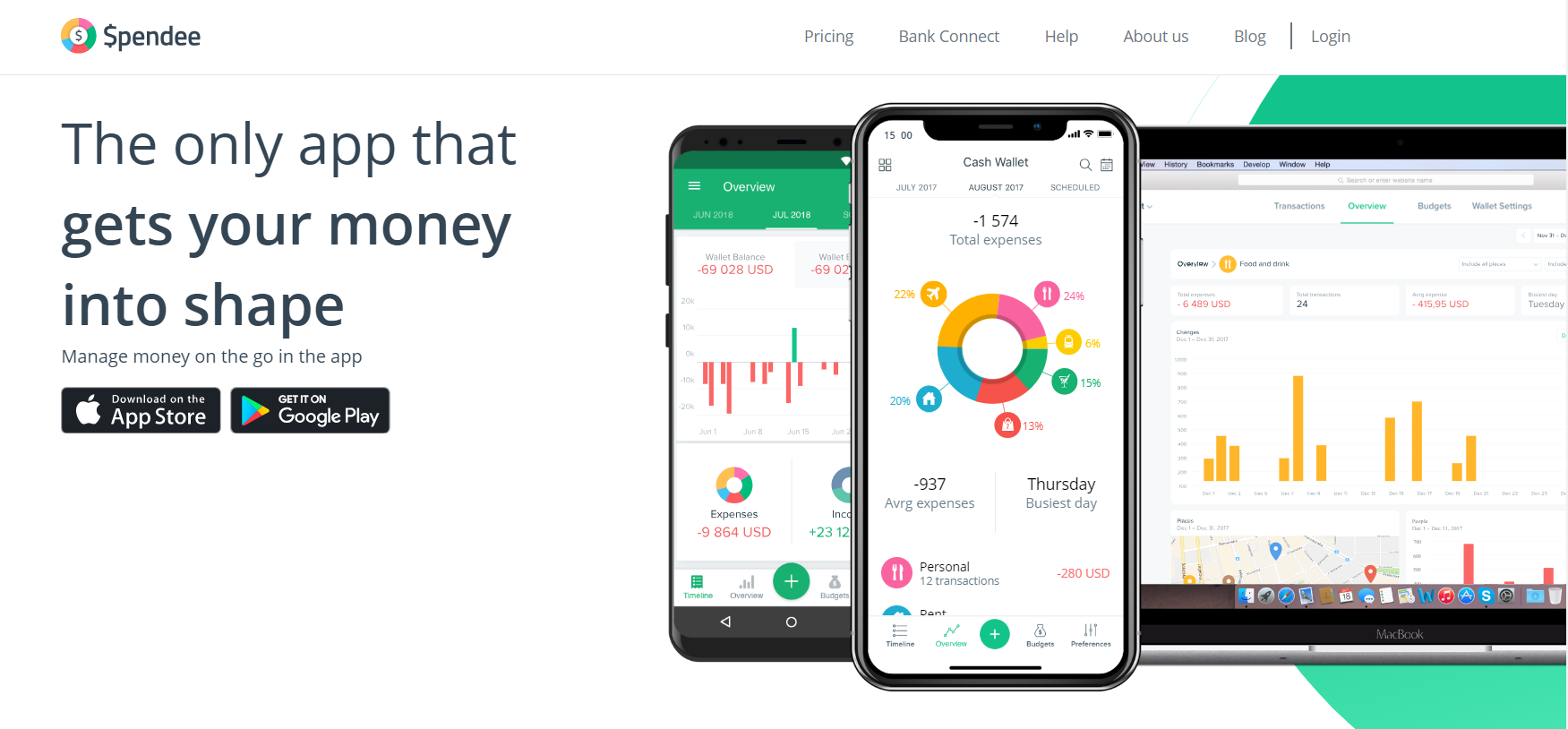

What does the Spendee app do?

Spendee is a budgeting app that simplifies the process of managing your finances and helps you keep everything in one place.

You will be able to create and access multiple wallets from a single app and have various functionalities for navigating and analyzing your money flows.

Features and Functionality

Overview of Spendee's Interface

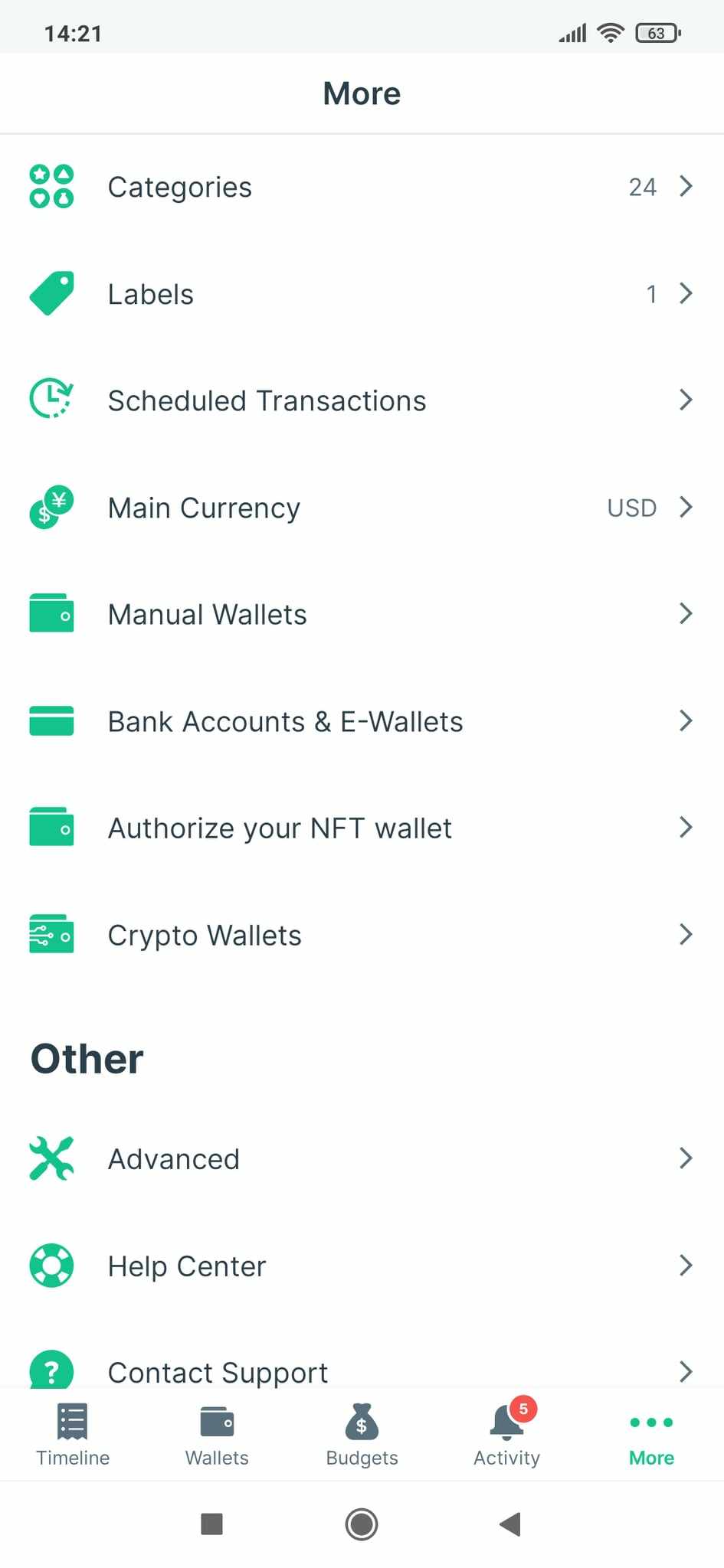

The application has an intuitive interface, with the Wallets, Budgets, and Timeline accessible from the bottom of the screen.

You can access categories, labels, and any additional features using the three horizontal dots representing "More".

In this section, you will also find advanced features, and settings such as Language, Currency, Password, etc.

You might not use all of the settings for your needs, but it's best to familiarize yourself with the interface before jumping into using it for your accounts and transactions.

Core Features

The app provides a lot of features, some of the main ones listed below:

→ Budget creation - setting an amount to reach will

motivate you to achieve this goal by visualizing it.

→ Scheduled transactions - you can set specific transactions to take place at a later date.

→

Shared wallets - this feature helps you communicate budgeting needs with your family members.

→ Import and export of data - you can easily transfer your information from another budgeting app, or download it to your device for future use.

→ Passcode for enhanced security - this will prevent unauthorized access to the app.

→ Themes (Light or Dark)

Transaction Tracking

You can add your daily transactions when you tap on Timeline and then tap on the + sign in the bottom right corner.

You also have the option to set the amount as recurring depending on the type of income or expense. There is an option for reminders of a week before the transaction which you can take advantage of.

Budget Creation and Management

One of the most valuable assets a personal finance manager can have is budgeting. The Spendee app provides a seamless budget creation by choosing a wallet, a category, and the desired currency.

You can make the budget recurring for simplified management. Once you add the new budget you will be able to track where your money goes, and how much you have left per day until the end of the specified period.

Labels

The labels in Spendee are yet another way to help you track your income and expenses. Once you set appropriate labels to your transactions, you will be able to access and assign them to your transactions.

You can think of labels as subcategories. If you have a more general category, e.g. Kids, then you can split this further into labels, such as Fun, Education, Clothing, etc.

Customization Options

The finance app provides several handy customization options. The first one that I want to mention is the currency availability. Spendee supports around 190 different currencies which makes it a suitable tool to use worldwide.

Another feature you can find convenient is the option to add a photo to your transactions. This could be a receipt, any other document, or just a reminder of what the transaction is about.

The next one is the language of the mobile interface. Language availability is less than the number of currencies, but it offers quite a few alternatives.

Advanced Features

The advanced functionalities are a useful way for people who need to set specific rules or use the data outside of the application.

They are preferred language, exporting as .csv or .xlsx (in the Premium plan), themes (dark or light), and setting up a passcode for security reasons.

In this section, you can also find the delete button to remove your account from their database. You can find the advanced features when you tap on More, and then scroll down to Other.

Custom Categories

One of the features that make this finance tool stand out is the customizable categories. It's an advantage they have over some of their competitors who offer adjustments to the categories together with a paid plan.

You can choose from a variety of icons and colors to best match your preferences. You can delete, add, or merge to further narrow your exact finance sources and expenses.

It's a fun way to have your money organized and implement creativity in the process. Arranging your financial matters can be far from boring with the huge choice of colors the tool provides.

Multiple Budgets

Currently, multiple budgets come with purchasing a plan. If you are a

freelancer and your salary is mainly from a single company with little variety of the projects you participate in, the free plan will be good enough.

However, managing multiple income streams, including household bills and expenses, will require adding additional budgets to your account.

Plans and Pricing

Free Plan

The free plan has certain limitations, but you will be able to test the main features and the categories. You will also get to test budget creation.

This plan is appropriate for new users who would like to experiment and check if the app fits their needs. You can also use this settlement if your accounting is simple and doesn't require a lot of budgeting features.

Premium Plan

If you choose to try out the paid version of the Spendee app, you have two options for setting the subscription.

You can either choose monthly or yearly billing. The yearly payment is expectedly cheaper, currently by 37%, and you will enjoy all the benefits of the app.

This plan includes all free features plus unlimited wallets, budgets, labels, syncing with your bank account, and sharing your wallets.

Lifetime Plan

If you are serious about using the tool and you've tested all its free functionalities, you can opt-in for the lifetime plan.

The main benefit of this

subscription is the discounted price compared to monthly or yearly payments. You will get a 50% off and use it unlimited.

Security and Privacy

To ensure better security you can set up a 4-digit code that you can use to access your wallets and budgets. This will prevent any unauthorized access and help you protect your financial information.

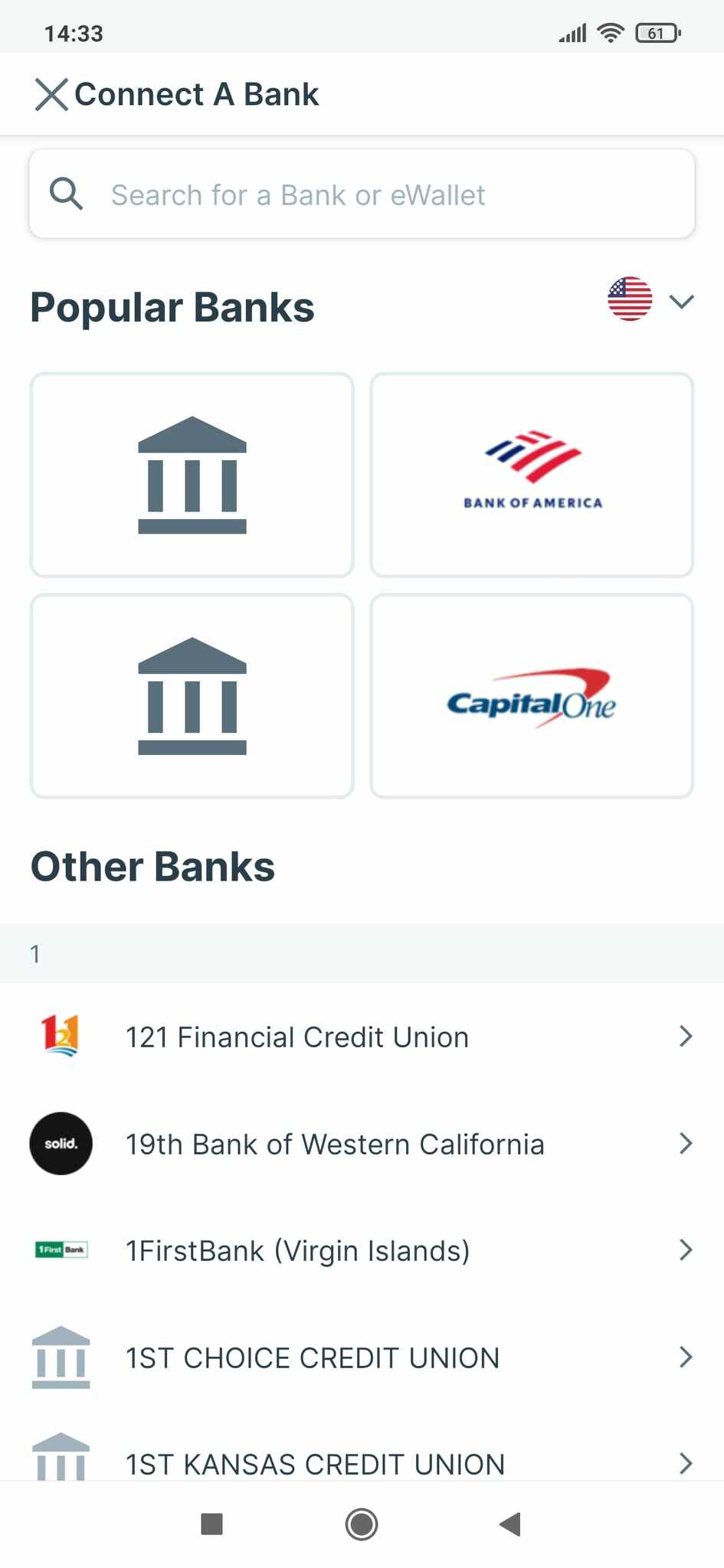

Is it safe to connect your bank account to Spendee?

Making sure your bank account is safe is one of the top priorities in terms of security. And it's also one of the reasonable questions first-time users have when they create an account with the app.

The answer to this concern is provided in their helpful resources, and you can also find it below for convenience:

We work with all financial account information in read-only mode 👀 to be able to check your account balance and download lists of transactions. However, we are not able to initiate payments or manipulate your account in any other way.

Simply put, yes, it is safe to sync your data. It will not be used to do any harmful activity on your behalf.

The app is very responsible in regards to privacy matters and you can be certain the data you provide will be handled with caution.

Spendee Review: Pros and Cons

Strengths of Spendee

↳ Various customization options.

↳ Globally available - multiple currencies are present.

↳ The interface is intuitive and easy to navigate.

↳ You have control over the preferred theme of the app.

↳ Fully customizable categories and labels.

Areas for Improvement

↳ The number of available languages could be increased.

↳ Some bank accounts are not supported.

↳ The most important features are under the Premium Plan.

↳ Competitors offer additional features.

Conclusion

You can use this tool as a freelancer to keep track of your finances and manage your income and expenses.

We covered all major points concerning this useful personal finance app in our Spendee Review. If you'd like to take a look at other finance apps for freelancers, check out my post about the best budget apps.

Thanks for explaining how Spendee works. This is the first time I heard about this app.

ReplyDeleteSpendee sounds like a financial lifesaver, neatly tying all your money matters in one handy digital knot.

ReplyDelete